One of the important financial decisions one can make is purchasing a home, which most people aspire to do. Most people choose a home loan to make this goal a reality. Whether you have the money to buy a home outright, a good loan makes your life goal easily attainable and is a preferable option. Getting a house loan comes with several tax advantages. However, because the housing loan interest rate is higher, you can pay more EMIs.

If you don’t have a proper strategy in place, your monthly budget may be severely stressed by your home loan EMIs. Keep in mind that the main factors affecting your monthly payment are your loan amount, the rate of interest on it, and the duration of the loan. Occasionally, a lack of forethought forces you to pay extra towards your debt. Always ask yourself how much home loan you can get, which you can pay back in timely EMIs. Below are some tips to reduce your home loan Interest rate.

– Choosing a shorter term

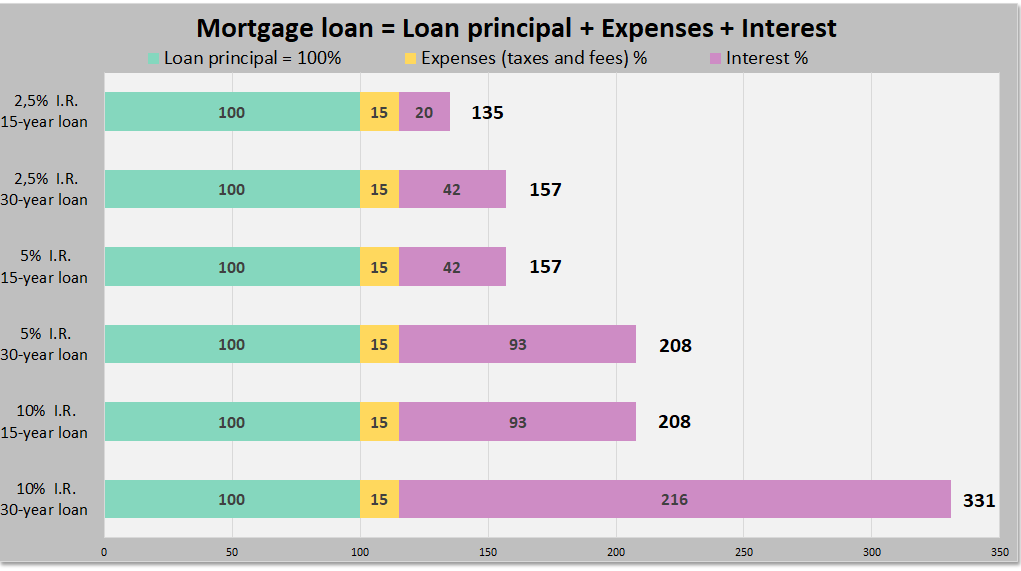

The loan term is one of the main elements determining the interest you must pay. Though lengthier tenures, such as 25 to 30 years, reduce monthly installments, shorter tenures reduce the overall interest due. Using a home loan EMI calculator, you can see how the interest is significantly lowered for loans with shorter terms. To avoid paying greater interest on your loan, carefully consider the tenure before applying for a loan.

– Increasing your down payment

Banks and other financial institutions often finance 75% to 90% of the home’s overall value. You must pay between 10% and 25% of the property’s remaining cost. However, paying extra from your own money as a down payment rather than paying the least amount possible is preferable. The loan amount will be smaller if you make a larger down payment, which will immediately cut the interest you must pay.

– Avoid Skipping Payments

- Lenders may consider you a fare evader and take measures against you if you miss three EMI payments in a row.

- The lender will issue you a letter informing you that failure to pay your debts by a specific date could result in losing custody of your collateral.

- Your credit score will be reduced by 50 to 70 points or more with just one default.

- If your income is interrupted, you can seek the lender and ask for EMI-free time.

- If you’re between employment or your business ventures have been delayed, banks often waive your EMI payments for three to six months.

– Raise your EMI

Some banks allow you to alter your instalment once a year. Therefore, if you change jobs and receive better pay, you can always opt for increased EMIs to shorten your tenure. Additionally, once the tenure is shortened, the total interest you must pay on your loan will drop significantly. See if such options are available by checking with your lender.

– Keep Your Credit Score High

How you handle loans is evident in your credit score.

A score of above 750 is regarded because it indicates financial soundness.

You would be viewed favourably by banks and lenders as a reliable borrower, and they would provide you with better loan terms.

Missed or late payments may be the cause of your low credit score.

To raise your credit score, Keep records of your payment history, the amount you owe, the duration of your credit history, new credits, and the categories of credit you now have.

Conclusion

Maintaining a steady and lengthy work history is another crucial factor. Lenders are more inclined to favour borrowers with long employment history and a consistent or increasing income. In contrast, banks or lenders may hesitate to approve your house loan if your employment history is irregular. A loan officer will confirm your work status before finalizing your loan. It will undoubtedly impact your likelihood of getting a house loan if you resign or switch jobs during the closing process. You must also compare housing loan interest rates before deciding on a lender. Many aspire to own a home, making home loans a necessary and inevitable aspect of our lives. The best way to live stress-free is to apply for and repay a house loan systematically in an organized manner.

Apart from this if you are interested to know more about Interest-Free Periods In Credit Cards Smartly then visit our Finance category